InfoResult Hub

What is the all time best Indian food/snack?

I am a huge fan of Indian food and snacks and I am often asked to point out the best ones of all time. With the vast variety of Indian cuisine, it's no easy task, but there are certain dishes that have always stood out for me. This includes finger-licking street food snacks, hearty main courses and mouthwatering desserts. So, join me as I share some of my all-time favorite Indian dishes that any food lover must try.

What are the common everyday struggles of life in India?

Living in India, everyday life can feel like a spicy curry of challenges, trust me! First off, traffic here deserves an Oscar for its chaos, turning every commute into an adventurous quest. Then there's the constant wrestling match with the weather, which switches from scorching summer to monsoon madness faster than you can say 'chai'. Oh, and did I mention the internet speeds? They're like a lazy elephant, taking its sweet time to get anywhere. But hey, amidst all these everyday struggles, we Indians find our joy and resilience, turning every obstacle into an opportunity for a good story!

Should we have a Supreme Court Bench in South India?

In my latest blog post, I've explored the pertinent question of whether there should be a Supreme Court Bench in South India. I've delved into both the pros and cons, considering factors like accessibility, regional diversity, and caseload management. On the flip side, I've also pondered the potential drawbacks such as resource allocation and potential regional bias. The discussion also highlights various opinions from legal experts, the public, and government officials. Overall, it opens up an important dialogue on the decentralization of our judicial system.

Why is there no quality of life in India?

While it's not entirely accurate to say there's no quality of life in India, it's undeniable that the country faces significant challenges. Widespread poverty, inadequate healthcare infrastructure, and educational disparity are some key issues impacting quality of life. Pollution, especially in urban areas, further contributes to health problems. Besides, corruption and bureaucratic inefficiencies often hinder social progress. However, it's important to remember that India is a vast and diverse country, with many working tirelessly to improve these conditions.

Indian Students and the Temptation of Outsourced Psychology Papers

It's been observed lately that many Indian students are falling into the trap of outsourcing their psychology papers. This trend is mainly due to the increased academic pressure and the desire to score high grades, making students turn to external sources. However, this approach not only undermines the essence of education but also threatens the credibility of the students' work. It's crucial for students to resist this shortcut and write their papers to foster their understanding and knowledge in the subject. The education system and teachers also need to encourage original work and discourage such practices.

Do you think foreign ladies like Indian men?

In exploring the question, 'Do foreign ladies like Indian men?', I've uncovered a variety of perspectives. It's important to recognize that attraction is subjective and largely depends on individual preferences. Many foreign women appreciate Indian men for their cultural richness, traditional values, and deep-rooted respect for women. However, like any other nationality, not every foreign woman might be attracted to Indian men due to personal preferences or cultural differences. Thus, it's not about nationality but more about personal character and shared values that drive attraction.

What are the best Indian snacks I can bring back to the U.S.?

In my recent exploration of Indian snacks, I discovered a variety of delightful treats that you can easily bring back to the U.S. From the spicy and tangy Khatta Meetha to the savory and crunchy Murukku, these snacks offer a taste of India's diverse culinary traditions. Another must-have is the sweet and delicious Soan Papdi, a flaky dessert that melts in your mouth. I also recommend the famous Masala Chai tea bags, perfect for a warm, comforting drink. These snacks are not only tasty but also travel-friendly and a great way to share India's rich food culture with your friends back home.

Why do most Air India flights crash?

Despite the alarming claim, it's important to clarify that most Air India flights do not crash. However, any aviation accidents involving Air India have often been attributed to a combination of factors including technical issues, human error, and adverse weather conditions. Safety regulations are stringent, but no system is entirely foolproof. It's crucial to remember that air travel remains one of the safest modes of transportation. The focus should be on continually improving safety protocols and training to minimize risks.

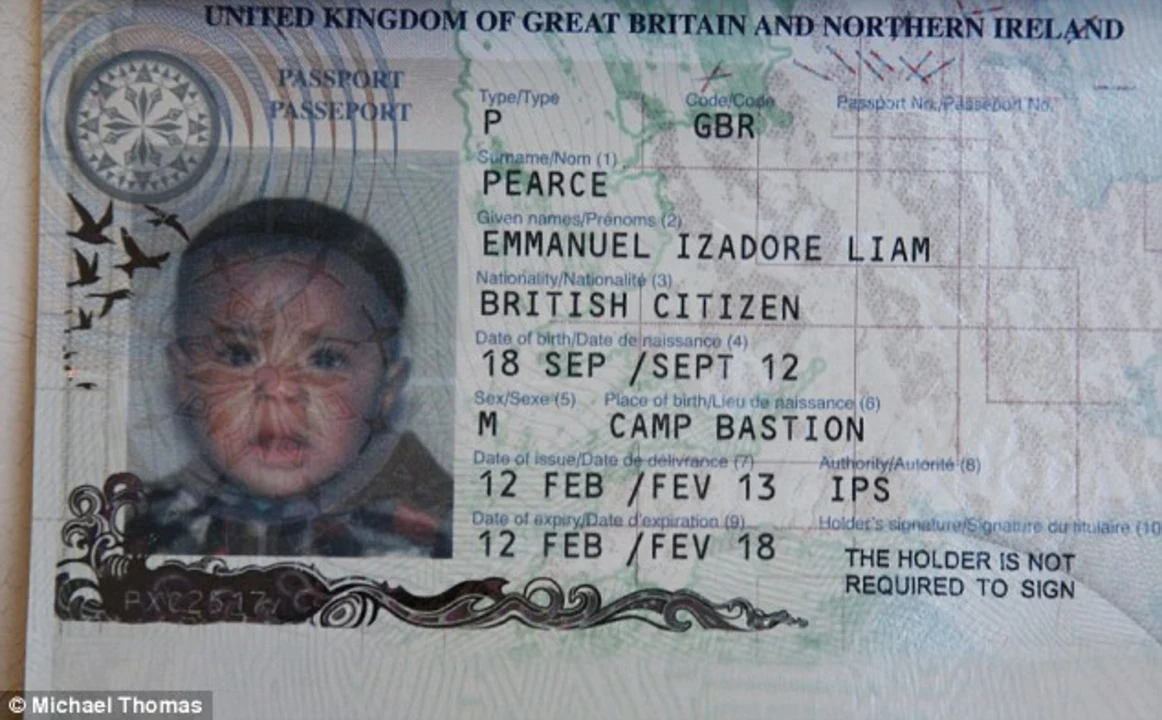

Is it easy to change the Place of Birth in my Indian Passport?

Changing the place of birth in an Indian passport can be quite a challenge. It involves submitting necessary documents and following a procedure to request the change. One must provide valid proof, such as a birth certificate, to support the change in information. This process can be time-consuming and may require multiple visits to the passport office. Overall, altering the place of birth in an Indian passport is not an easy task and requires patience and persistence.

What were some guns used by Native Americans?

Native Americans used a variety of weapons in their culture, including guns. Some of the common firearms used by Native Americans were flintlock muskets, rifles, and shotguns. The flintlock musket was the most commonly used type of gun, as it was reliable and easy to use. Rifles were used for hunting and were often used in warfare. Shotguns were used for hunting bird and small game, and were also used for protection against predators. Native Americans also used bows and arrows, spears, tomahawks, and various forms of hand-to-hand combat weapons.