Understanding PAN Cards: How to Get, Verify, and Use Your PAN

If you’ve ever filled out a tax form or opened a bank account in India, you’ve seen the term PAN. It stands for Permanent Account Number, a ten‑digit alphanumeric code that the Income Tax Department issues to individuals and entities. Think of it as your tax‑ID that ties all financial activity to a single identity. Because the government uses PAN to track tax payments, having a valid PAN is mandatory for most money‑related tasks.

How to Apply for a PAN Card

The simplest way to apply is online through the NSDL or UTIITSL portals. You’ll need a recent photograph, proof of identity (Aadhaar, passport, or voter ID), proof of address, and a birth certificate or school certificate for date of birth. Fill in the form, upload scanned copies, and pay the INR 110 fee (plus service charge if you use a third‑party agent). After payment, you’ll receive an acknowledgment number that lets you track the application.

If you prefer the offline route, grab Form 49A from any PAN service center, attach the same documents, and submit the form with the fee in cash or a demand draft. The processing time for both methods is usually 15‑20 working days, but you can get a temporary “acknowledgment receipt” that works for most transactions while you wait.

Once the card is ready, it’s mailed to the address you provided. When it arrives, check that the name, date of birth, and PAN number match your records. Any mistake means you’ll have to file a correction request, which takes another 7‑10 days.

Common Uses and Benefits of Your PAN

Having a PAN opens doors to many financial services. You need it to file income tax returns, of course, but you’ll also use it for:

- Opening a savings or current bank account.

- Buying or selling property and vehicles.

- Investing in mutual funds, stocks, or government bonds.

- Receiving large cash deposits or withdrawals over INR 50,000.

- Applying for loans, credit cards, or insurance policies.

Because the tax department links all these activities to your PAN, it helps prevent tax evasion and reduces fraud. That’s why financial institutions ask for PAN every time you make a big transaction.

If you already have a PAN but lost the card, you can request a duplicate online. The process is the same as a fresh application, except you select “Duplicate PAN Card” and pay a lower fee (around INR 100). The new card arrives within a week.

Updating details such as your name after marriage or a change of address is also straightforward. Submit a correction form with supporting documents, and the department will issue an updated PAN card. Until the new card arrives, you can use the same PAN number for all transactions.

Many people wonder if they can use the same PAN for a company and personal accounts. The answer is no – a PAN is unique to each entity. If you run a business, you’ll need a separate PAN for the firm, even if the owners already have personal PANs.

To verify someone’s PAN, you can use the Income Tax Department’s “PAN Inquiry” service. Just enter the name and PAN number; the system confirms whether the details match. This quick check is handy when you’re dealing with a new vendor or a loan applicant.

In short, a PAN card is more than a tax requirement; it’s a universal identifier for all your financial dealings. Apply early, keep your details current, and use the verification tools to stay on top of your financial health.

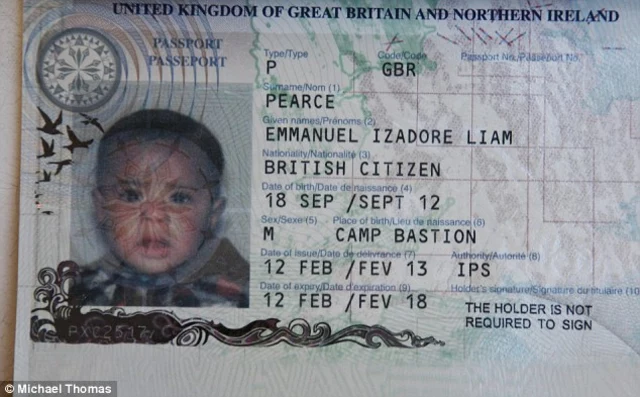

What documents are considered proof of Indian citizenship?

Proof of Indian citizenship can come in many different forms, such as passports, birth certificates, Aadhaar cards, voter identification cards, and PAN cards. All of these documents must be issued by the Government of India and bear the Indian citizen's name, photograph, and other personal details in order to be considered valid. Furthermore, these documents must be kept up to date and renewed or replaced when they expire.